By: Brady Raanes

The first half of 2025 is in the books and it was a rollercoaster for markets.

The Trump administration imposed sweeping tariffs in April, dubbed “Liberation Day,” triggering a sharp decline in stock prices. Trump paused the highest tariffs for 90 days to allow trade negotiations but kept universal 10% tariffs in place and increased Chinese tariffs to 135% briefly.

The economy contracted by 0.5% (measured by GDP growth) in the first quarter, the first decline in three years. Consumer spending slowed sharply from 4% growth in Q4 2024 to just 0.5% in Q1 2025. Inflation remained sticky and ticked up slightly, rising to 2.7% in May (core PCE).

Aside from the economic numbers, the administration bombed Iran, argued with Ukraine, debated taking over Greenland, discussed making Canada the 51st state, renamed the Gulf of Mexico, joked about becoming the Pope, appointed Elon Musk to cut government costs, had a falling out with Elon, and passed an 887 page tax bill.

Despite the chaotic headlines, the labor market remained resilient, with job growth averaging around 140,000–150,000 per month and unemployment falling back near 4.1%. Corporate earnings remained solid and the Federal Reserve held interest rates steady.

Despite it all, the stock market rose by about 6% in the first half of the year..

How? Why? What’s next?

Thus far, 2025 has been yet another example of how headlines can trigger short-term volatility and fear, but corporate earnings are the most important factor to stock investors. So long as corporate earnings remain strong, the stock market can move higher.

Let’s examine a few factors that could impact corporate earnings in the second half of 2025: (1) Consumer Spending, (2) Profit Margins, and (3) Interest Rates. As you’ll see, the results are mixed and don’t paint a real clear signal.

Consumer Spending

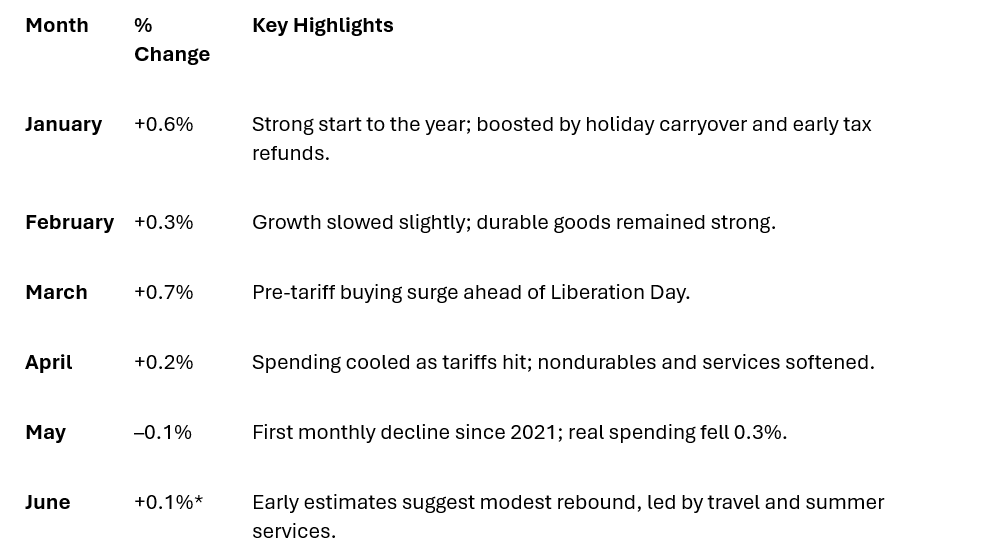

After a strong start to the year, consumer spending slowed. Spending fell 0.1% in May, marking only the third monthly drop in four years.

Monthly Consumer Spending (% Change from Previous Month)

Source: https://www.bea.gov/data/consumer-spending/main

*June data is preliminary and subject to revision.

At first glance, the slowdown in consumer spending gives cause for concern, but job growth has remained relatively strong, which leads us to believe the slowdown in spending may be precautionary in nature rather than a symptom of a larger issue. Should we see an increase in unemployment we would feel differently. The strong job market is also impacting the decision of the Federal Reserve. More on that later.

Profit Margins

Profit Margins peaked at 11.6% in the 4th quarter of 2024, boosted by strong holiday sales and improved productivity. Margins fell to 10.9% in the first quarter of 2025, reflecting rising input costs and wage pressures. The most recent reading suggests a decline to 10.7% in the second quarter, as consumer spending slowed and companies faced tighter pricing power. While corporate profits remain historically high in dollar terms, profit margins are tightening, which may suggest that companies are struggling to pass on rising costs to consumers. This could signal a more cautious business environment ahead.

Tariffs pose one of the biggest risks to profit margins. Tariffs ultimately increase the input and production costs for companies reliant on importing materials or product components. Sectors like automotive, homebuilding, and consumer goods are particularly vulnerable, and may face difficulty passing on higher costs to consumers. Investors and analysts may not have fully priced in the impact of tariffs to profit margin. I expect to see some downward revisions to earnings estimates once the full scope of tariffs becomes more clear.

Interest Rates

Last fall, the Federal Reserve reduced interest rates to the current range of 4.25% - 4.50% citing concerns around slowing economic data. The economy has stayed afloat thus far, but concerns remain and pressure is growing for the Feds to cut rates again. However, there are mixed signals coming from the economic data that is complicating their decision.

In 1913, Congress tasked the Federal Reserve with a dual mandate to conduct monetary policy in such a way to: (1) keep inflation in check and (2) support maximum national employment. For instance, the Federal Reserve slashed interest rates during COVID to encourage companies to borrow, expand and hire more employees in an attempt to stimulate the job market.

When inflation ramped up following the COVID stimulus and supply chain issues, the Federal Reserve shifted their concerns from the job market to inflation and began increasing interest rates in an attempt to bring inflation down. The increased cost of borrowing drove down demand for big ticket items like houses, cars, and corporate expansion projects which put a damper on inflation.

Inflation trended lower over the next three years and currently hovers around 2.5%; which is still slightly higher than the targeted inflation rate of 2%. There is also reason to believe that increased tariffs could lead to higher prices and spur additional inflation.

On the other hand, the job market is still relatively strong although we may be seeing signs of weakness. The most recent jobs report (released July 3rd) showed that the US added 147,000 jobs in the previous month, more than expected, but still below the 200,000+ jobs created per month from 2022-2024. Still, the recent jobs report was positive enough to support the Feds current stance and doesn’t signal an obvious need for a rate cut.

The Federal Reserve is under political pressure to reduce interest rates based on the belief that a lower Fed Funds rate will (1) reduce government borrowing costs, (2) stimulate the broad economy, and (3) increase employment. However, rate cuts may not work as desired and could lead to some unintended consequences.

What could go wrong

When the Federal Reserve cut interest rates last fall, the longer-term interest rates (such as mortgage rates and government bond yields) actually increased; the exact opposite of the intended outcome. How is this possible?

There is a general misconception that the Federal Reserve controls all interest rates in our country, but that’s not actually the case. The Feds only controls the overnight lending rate charged between banks, known as the Fed Funds Rate. The Feds don’t control government bond yields, mortgage rates, car loans or credit cards.

By increasing or decreasing the rate that the Feds charge banks to borrow money, there is a general belief that there will be a trickle-down effect on interest rates throughout the broad economy. However, that’s not always the case.

Here’s where things get complicated. There is still a “supply and demand” aspect when it comes to treasury bonds and mortgages. Regardless of what the Feds do with interest rates, the US government has roughly $10 trillion of outstanding debt that will need to be rolled over in 2025 and another $9 trillion in 2026. The interest rate that the US ends up paying for this debt will depend greatly on the supply/demand dynamics of investor appetite.

The larger our federal deficit grows, the more bond buyers will be required to purchase bonds to fund the deficit. As a result, it’s entirely possible that Fed rate cuts will have a little to no impact on the borrowing cost of the US government if supply outpaces the demand for government bonds. Higher yields may be required to incentivize the additional investors needed to purchase bonds.

It’s also possible that a Fed rate cut could be a signal to investors that the US economy is slowing more than expected, which could spook investors rather than setting off a booming economy. Historically, lower rates haven’t always been a blessing for stock investors.

Sometimes markets respond positively, such as in 1980 and 1998. Other times, the rate cuts are merely the beginning of a larger economic slowdown, such as 1973, 1981, 2001, and 2007. As you can see in the chart above, it’s a bit of a mixed bag.

The interest rate conversation will be an important input for the economy in the second half of the year. The current Chairman of the Federal Reserve, Jerome Powell has been a growing target of Trump’s criticism for now reducing rates at a quicker pace. Powell’s term ends in 2026 and it wouldn’t be surprising to see continued fireworks between the President and Fed.

Expectations

The next six months will certainly hold many of the same unexpected and shocking headlines as the first half of the year. We expect continued geopolitical tensions, further debate surrounding tariffs, and plenty of volatility from markets. It’s entirely possible that the stock market continues to climb the wall of growing concerns so long as profits remain strong.

On the other hand, economic reports continue to suggest that the economy is slowing. Any erosion of corporate earnings would be bad news for stock investors. Stock valuations are still rather expensive from a historic standard and may be susceptible to sudden drawdowns if expectations fall flat.

Regardless, our main risk-taking metric is still positive (the average price of the S&P 500 over the last 5 days is above the 200-day moving average), thus we remain invested for growth and hopeful that the market strength in the first half of the year carries through.

Any opinions are those of Brady Raanes and not necessarily those of Raymond James. This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Expressions of opinion are as of this date and are subject to change without notice. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein.

The investments mentioned may not be suitable for all investors. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Investing involves risk and you may incur a profit or loss regardless of the strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.